THE COAL & PETCOKE

HOME / COAL & PETCOKE

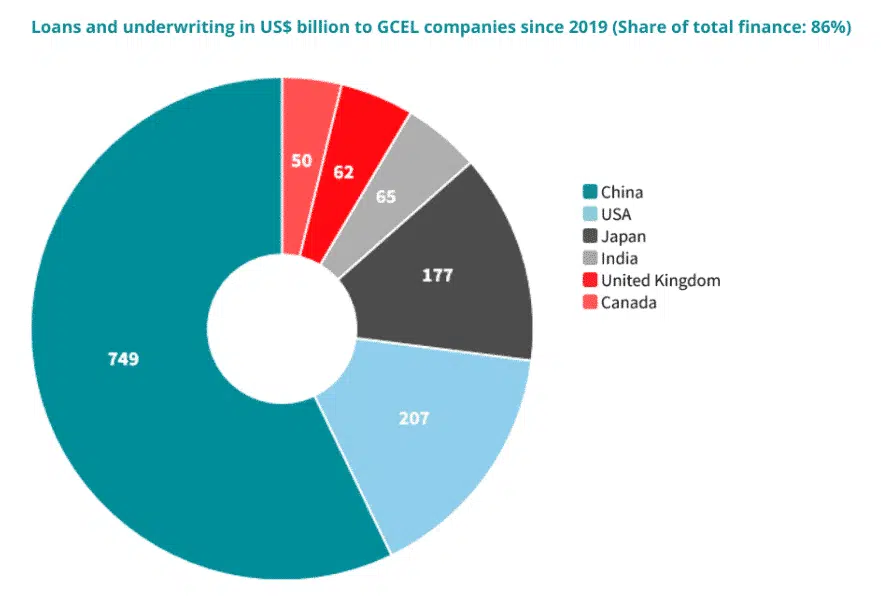

Who Is Financing Coal?

Leading banks, pension funds, asset managers, mutual funds, and other institutional investors are financing the coal industry.

According to the report, almost 50% of the coal financing between 2019 and 2023 was provided by 12 banks. Furthermore, the report points out that ten banks are part of the Net Zero Banking Alliance.

INVESTING IN COAL

Investments in Coal Developers

Additionally, the report found that the BlackRock, a multinational investment corporation, was the largest investor in coal development companies, contribute USD 34 billion. Its portfolio includes companies that plan to build over 200 gigawatts (GW) of new coal capacity. This is the equivalent of the combined coal fleets of Russia, Japan, Indonesia, Poland, and Germany.

TAKE THE NEXT STEP TO INVEST

MKM72 HOLDINGS partnerships are structured to maximize the potential benefits of direct participation in coal exploration and production. Contact us to learn more.

The Implications for Continuing Investments in Coal

The continuing financial support for coal-related companies brings about negatives on several fronts.

First, it moves against the Paris Agreement targets, as the coal industry is the most significant contributor to climate change. The ongoing support will not change the status quo but rather strengthen it. According to Katrin Ganswindt, head of financial research at Urgewald, almost no coal companies are transitioning to new business models. And with the financial support from banks, they are unlikely to do so anytime soon.

Adverse effects will carry on to banks and financial institutions, too. They risk exposure to stranded assets in the future and take on evermore reputational risk as the world moves toward clean energy.

CONTACT MKM72 HOLDINGS

Only approved qualified investors may invest with MKM72 HOLDINGS